India’s Phone Market Booms: Apple’s Rise, 18% Growth in Q3.

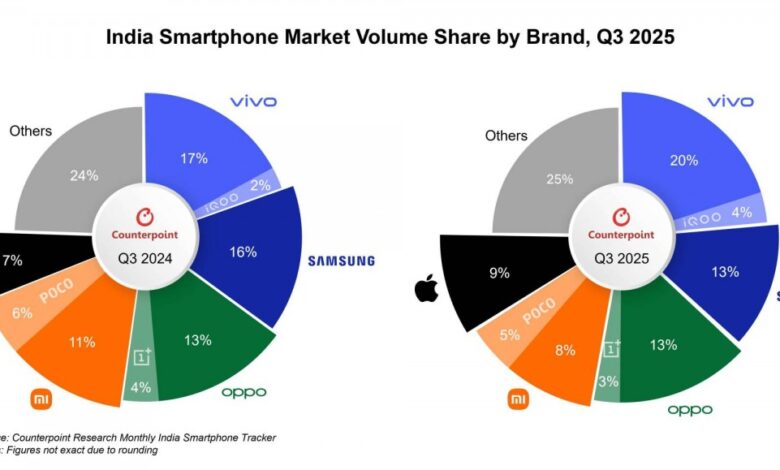

Counterpoint Research’s analysis of the Indian smartphone market for Q3 2025 reveals positive trends, characterized by both volume and value growth. The market exhibited a 5% year-over-year (YoY) increase in shipment volume compared to Q3 2024. Significantly, the market experienced an 18% YoY expansion in value, indicating a shift towards higher-priced devices.

This value growth is primarily attributed to the expansion of the premium segment, encompassing smartphones priced above INR 30,000. Shipments within this segment surged by 29% YoY, driven by strong consumer demand for flagship devices from Apple and Samsung. Apple demonstrated significant influence, securing 9% of the total shipment volume while commanding an impressive 28% of the market value share. Samsung secured the second-highest value share, representing 23% of the total market value.

In terms of shipment volume, Vivo emerged as the leading brand, securing the top position, and held the third position in value. Vivo’s success was largely driven by its T-series midrange smartphone offerings.

iQOO experienced the most significant growth in terms of shipment volume, achieving a 54% YoY increase. Motorola also demonstrated robust growth, with a 53% YoY increase in shipments, fueled by the demand for its G and Edge series. Lava was the fastest-growing brand within the sub-INR 10,000 segment.

From a chipset perspective, MediaTek maintained its leadership position in the Indian smartphone market, holding a 46% market share. Qualcomm secured the second position with a 29% market share.

Source