Samsung’s Q3 Domination: Smartphones Reign Supreme, Leading the Market.

Recent data released by Omdia reveals the smartphone market performance for the third quarter of the year, spanning July to September. The report highlights key trends and identifies leading vendors based on unit shipments.

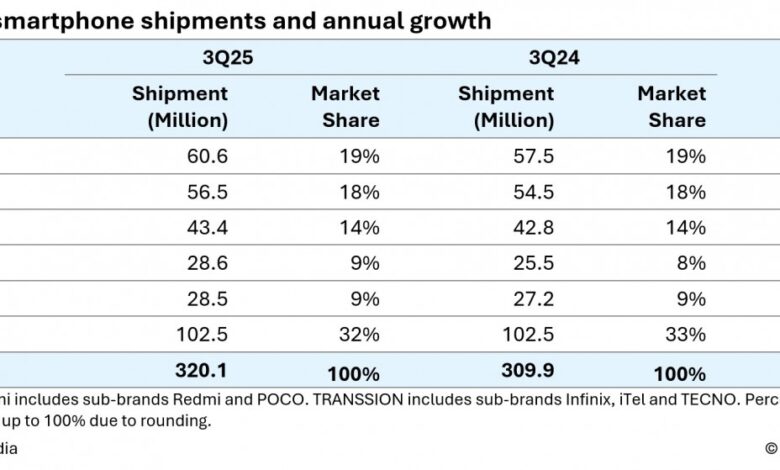

Samsung secured the leading position with 60.6 million units shipped, representing a 19% market share. This marks a 6% year-over-year (YoY) increase. Apple followed in second place, shipping 56.5 million units and holding an 18% market share, reflecting a 4% YoY growth. Xiaomi secured the third position with 43.4 million shipments, capturing 14% of the market and experiencing a 1% YoY increase. Transsion, encompassing the Infinix, iTel, and Tecno brands, took fourth place with 28.6 million shipments and a 9% market share, demonstrating the highest YoY growth among the top five vendors at 12%. vivo rounded out the top five, shipping 28.5 million units and holding a 9% market share, with a 5% YoY growth.

Samsung’s growth was fueled by the Galaxy Z Fold7 and Flip7 models, alongside the A07 and A17 series. Apple’s base iPhone 17 saw stronger-than-anticipated sales due to its improved value proposition. Xiaomi experienced a decline in shipments within China following the cessation of state subsidy programs, though growth in the Asia-Pacific and other regions offset this. vivo sustained its momentum in India, surpassed Huawei in China, and expanded its presence across the Asia-Pacific, African, and Latin American markets.

The overall smartphone market saw a total of 320.1 million units shipped in Q3, reflecting a 3% YoY increase. While North America and Greater China experienced YoY shipment declines, significant growth was observed in the Asia-Pacific, Middle East, and African regions. Notably, Africa witnessed a 25% increase in shipments, and Asia-Pacific grew by 5%.

Omdia’s analysis indicates that market growth is primarily driven by devices priced under $100 and above $700, while the mid-range segment remains relatively stagnant. Future projections anticipate an increase in average device prices, which is expected to potentially hinder growth within the low-end segment.

Source: Omdia